C.H. Douglas was a British engineer who, in the 1920s, founded an international movement for monetary reform centred on his ideas which were known as "Social Credit".

Now, I must be clear that the Social Credit we are talking about here has nothing to do with the totalitarian surveillance system that has just been introduced by the Chinese government. For some strange reason, the Chinese have decided to call it ‘Social Credit’, and this has created a problem. Whenever we Social Crediters talk to people about Douglas Social Credit, real Social Credit, very often people will confuse it with this Chinese programme. That’s unfortunate.

During his life, Douglas had published several books and articles, had given innumerable speeches, had spoken before government committees in Canada, the United Kingdom, and New Zealand, and also before the King of Norway.

In Canada we had Social Credit governments in British Columbia and Alberta that lasted for decades. Unfortunately, any attempt to introduce Social Credit or any aspect of it was thwarted by the federal government, the courts, the governors, or the imperial government in London, with the argument that, according to the terms of the British North American Act, these provincial governments had no jurisdiction over banking. Even so, there were, in the early Sixties, thirty or so Social Credit members in the House of Commons in Ottawa. Social Credit has had a long and involved history, especially here in Canada.

But today, if we talk about Social Credit with anyone younger than 60 or 50 years old, chances are that either they do not know anything about Social Credit, or they will immediately think about the Chinese experiment.

Personally, I believe that Douglas has some rather important things to contribute to the discussion of monetary and economic reform and that is why I have dedicated my life, in fact, to the study of Douglas and the dissemination of his ideas.

Part I: The Diagnosis of Social Credit

To fully understand Social Credit, one must first understand Douglas’ philosophical point of view.

According to his vision of the world, the economy has a distinct purpose, and its goal is to produce the goods and services that people need with the least amount of effort in terms of human labour and resource use.

So, the correct purpose of the economy should serve as our starting point in approaching the issue of economic functionality.

Douglas says, and this is exactly what we can see around us ourselves, that, from a physical or realistic point of view, our economies are not fulfilling that goal; they are failing to one degree or another.

And we can summarize this failure in three sentences:

- "Poverty in the midst of plenty" ... that is to say, although there are enough goods and services, or could be enough, to satisfy all the necessary needs of human beings, there are many people who suffer privation.

- "Servility instead of freedom" ... that is to say, although we could, in the West anyway, provide these necessary goods and services with fewer and fewer people working in the formal economy (thanks to technological advances), we continue to insist on a policy of full employment (structurally and culturally) when we could and should be enjoying more free time.

- "Waste instead of efficiency" ... that is, although we could satisfy the needs for goods and services in a much more direct and easy way, using less of our productive capacity (relative to any particular production program), we produce many things that would not be desired by the ‘independent’ consumer. And you can imagine the effect of such waste on the environment!

And so, we can ask the question: what is responsible for the failure of the economy?

According to the analysis, Douglas's diagnosis, that which prevents the economy from achieving its goal to the extent that it is physically possible, is finance, that is, the financial system.

And what is the problem with the financial system? In a word, the financial system that governs us today is not an honest system. That is, it is not designed to provide an accurate picture either of our physical ability to produce wealth or of the flow of real wealth.

The financial veneer that the system imposes gives us the impression that we are physically poorer than we actually are, that there is a real scarcity of things that we need and, as a result, economic life is much harder in one way or another, than the physical facts of the economy would necessitate.

Well, this financial lens that limits, conditions, and poorly directs our economic activities manifests itself in two main ways: at the level of production and at the level of consumption.

To better understand these two dimensions, we will ask two questions that will allow us to better orient ourselves.

But before doing that, there are some other things that must be recognized:

First, there are two sides involved in modern economic activity: the physical or real side, which consists of the materials, machines, human labour, know-how, i.e., all the economic resources that exist in the world independently of the human mind and through which alone goods and services can be produced.

And, on the other hand, there is the financial side, which is a completely virtual reality, a fabrication of human beings that exists only in their heads and in their records. But ... and that's the most significant thing, the financial system nevertheless determines the monetary rules according to which the economic game must be played.

Second, the financial system itself incorporates two flows of credit or money: the flow of credit to producers, and the flow of credit to consumers.

So, let's look at the first question. It deals with the relationship between the financial system and the physical side of the economy that relates to production:

“Under the current financial system, is the flow of credit to producers sufficient to catalyze the production of all productive capacity?”

The answer of Social Credit, of the Social Crediters, is 'No'.

What does that mean exactly?

It means that it happens very often that there is, on the one hand, a legitimate need on the part of the people for some good or service, and, at the same time, there is, on the other hand, the physical resources, materials, work, machines, know-how to satisfy this need ... and yet, the production is not accomplished simply for lack of money.

This problem of artificially limited production is a great problem for the developing countries, but it is also a problem for the so-called developed countries.

In Canada, for example, it is often the case that people who need certain health services, MRI scans or CT scans, or certain types of surgery, cannot get them in time because of lack of money in the health system ... not because there are no additional pieces of equipment that could be purchased, or no additional surgeons that could be hired or trained.

And now for the second question, which is a question about the relationship between the financial system and the physical side of the economy that is concerned with consumption:

“If we produce a certain volume of goods or services, are we automatically (and this is the key word) paid, as consumers, enough money in the form of income to ensure the full distribution of these goods and services (i.e., the sale of all goods and services) and the final liquidation of all corresponding production costs?

And again, according to Douglas' analysis, the answer to this second question is also ‘no’.

There are many cases, for example, where people, considered globally, do not have enough income to buy what is offered to them. Therefore, if they want to buy, they have to borrow to buy, which usually involves borrowing new money from the private banking system to supplement the revenue stream.

Finance is also, therefore, an artificial limitation on our ability to consume what we produce.

We thus see that, in the field of production, the actualization of the physical productive capacity of the economy is dependent on an insufficient flow of credit to the producer and the same applies in the field of consumption: the distribution of the flow of real wealth and the liquidation of its costs is also dependent on a flow of consumer credit in the form of insufficient revenues.

The two artificial constraints are intertwined because if you cannot easily sell all the goods you produce, there is no basis for further increasing the flow of production credit in order to increase the desired production of goods and services.

Summary of the General Problem with the Economy

So instead of having a financial system that simply reflects, in a one-for-one correspondence, the production capacity and the flow of real wealth, we have a financial system that systematically underestimates them and that transforms money into a ‘rare commodity’ and finance into the determining factor. The symbol of our wealth, and of our ability to produce it, becomes more important than the reality of our wealth. And finance, as an institution, becomes master instead of servant, because, in order to overcome the artificial shortcomings and constraints that finance creates, we must appeal to finance on its terms and in accordance with its interests.

This artificially induced dependence reverses the order that ought to exist between the financial system and the physical or real economy.

In sum, the financial system is not a humble servant of the physical economy, of what we need, and of what we want to do with the physical economy. Instead, the physical economy, the real economy, is subordinated to the financial representation of the real economy. And that's the general problem with the economy.

If we were to imagine a dog representing the real economy and its tail representing the financial system, the current financial system, because it is structurally dishonest, allows the financial tail to shake the dog of the real economy. But this is a complete perversion of the due or correct order, the order required for healthy functioning. In this order, the dog of the real economy is master of the situation, the financial system is subordinated to it and the dog stirs the financial tail as, when, and where required.

Part Two: The Causes, The Palliatives, and the Consequences of the Chronic Lack of Purchasing Power

Given that a more liberal flow of production credit depends on a more liberal flow of consumer credit, we will explore more deeply what causes the chronic lack of purchasing power in the form of income and what the current financial system does to address the situation.

In his book The New and The Old Economics Douglas explains that there are, at least, five major causes behind the lack of purchasing power: profits (including profits from interest payments), savings, reinvestment of savings, deflationary banking policies, and the difference in circuit velocity between cost creation and price liquidation in the price system, also known as the A + B theorem.

I will focus our attention on the last cause because, according to Douglas, this is the most important cause. The basic idea is that, for reasons of industrial cost accountancy in connection with the creation and destruction of money by banks, companies always generate costs and therefore prices at a faster rate than they simultaneously distribute incomes to consumers.

The problem is that companies have to charge the consumer for the use of real capital, but the real capital implies financial, depreciation, and maintenance costs that are greater than the incomes that are simultaneously being distributed in the name of, or on behalf of, real capital.

There is an inherent imbalance in the system, where total costs, and therefore prices, always exceed total revenues. This does not mean that there can never be a balance between the costs and prices of consumer goods and services and the incomes distributed to the consumer in the existing system, but this requires the system to introduce some palliatives to fill the gap.

So, before looking at how Douglas proposed to rectify the system, it would be instructive to examine how the current system attempts to compensate for the chronic lack of purchasing power in the form of consumer income that would liquidate all costs. This imbalance must be addressed in one way or another in order to achieve a certain balance.

It is possible, and sometimes it is the case, that the economic system achieves parity of flows by lowering the cost / price flow, thus bringing them into closer range of consumer incomes. This occurs when companies sell at below-cost prices for a specified period of time because economic conditions are unfavorable, or when they do so to liquidate their business because they are headed for bankruptcy. This will allow them to repay as many creditors as possible.

But the problem with this method is precisely the fact that it does not cover all the costs and therefore leads to business and economic stagnation. For this reason, it is better to reduce costs by resorting to government funding, as is the case when governments subsidize production, if we want to try to close the gap by reducing costs.

In general, the most effective way to reduce this gap is to increase the flow of consumer incomes so that it matches the cost / price flow.

The increase in the flow of consumer income often takes the form of new production, that is, an expansion of production facilitated by money borrowed from the banking system. This expansion can be public or private. It is more advantageous if it takes the form of capital production, rather than the production of consumables, since capital production, while increasing the flow of income to consumers by distributing wages, profits, and additional dividends, etc. ., does not increase, in the same period of time, the flow of costs and consumer prices, or, in the case of public production, of taxes. For example, governments can build roads, hospitals, schools, ports, airports, pipelines, other types of infrastructure, whether they are needed or not, while companies can build more plants and buy more machines, relying on clever advertising to sell the production at any given time. A blatant example of this method of bridging the gap would be when a government decides to go to war, at least in part, as a way to re-inflate a struggling economy.

To the extent that all this and other forms of production are done primarily to provide additional income through employment and profits, so that what we have already produced can be paid for and distributed, it is a waste. The same result could have been achieved without all the work and the need to pay for and absorb its future production simply by issuing a cheque for the missing income on the part of the state. We will come back to this point soon.

This is why the current financial system is so focused on economic growth. The economy must grow and expand exponentially, whether or not the resulting output is really needed, in order to maintain a balance between the flow of consumer goods and services and the flow of consumer incomes.

Another way to increase the flow of consumer buying power would be to encourage consumers to borrow new money in the form of mortgages, car loans, student loans, personal loans, credit cards, lines of credit , purchase plans, etc. This increases the purchasing power of consumers and does not increase the flow of production costs, but increases the flow of costs that will be debited against the future incomes of consumers.

A last method to offset this gap is to export more than you import or to establish a ‘favorable trade balance’. This effectively reduces the gap in two directions: it reduces the flow of costs / prices that have to be recovered from consumers in the domestic market and increases the flow of consumer purchasing power in the form of the profits and incomes of exporting companies.

It is inflationary to close the gap with more bank debt, as the resulting costs will ultimately be passed on to consumers, in the form of higher prices, taxes, or debt servicing charges. In order to maintain the standard of living in these conditions of increasing financial stress, citizens will demand wage increases to compensate. But these are also costs and they will eventually affect the consumer market in increased prices. As a result, the purchasing power of each monetary unit will depreciate over time.

Other consequences of traditional methods of managing the price-income gap include: the recurrent cycle of economic trials and downturns, economic inefficiency, waste, and sabotage, forced economic growth, an exponentially increasing mountain of societal debt that is, in the aggregate, unrepayable, heavy and often increasing taxation, the usurpation of the increment of association by the private banking system, the centralization of economic wealth, privilege, and power in fewer and fewer hands, social conflict, forced migration, cultural upheaval, environmental degradation, and international economic conflict leading to war, etc., etc.

Part Three: The Social Credit Remedies

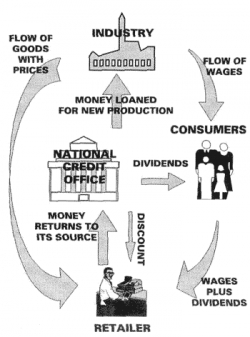

So, how does Social Credit propose to correct the artificial lack of credit to producers and how does it correct the artificial lack of consumer income? Obviously, the financial system needs to be rethought/redesigned. A "National Credit Authority" would be created and charged with ensuring that the financial system is sufficiently flexible and accurate enough to provide all the monetary parameters that the realization of the physical economy requires. A fundamental axiom of Social Credit reads: "All that is physically possible (and desirable) should be financially possible". In the case of producer credit, the production capacity of the company, composed of raw materials, labour, machinery, know-how, etc., could be considered an asset against which new money can be created and issued to catalyze production. If there are unmet needs for goods and services on the one hand, and an unused capacity to provide those goods and services on the other hand, additional funding can and must be created until these needs are met or until the productive capacity of society is fully exploited. Additional credits could still be granted to further develop the productive capacity of society if there is a need. It is always possible in the financial field to increase the rate of producer credit creation that can be made available to productive organizations, provided that there is: a) a demand for the resulting output (and that consumers are willing and able to pay for it) and b) there are sufficient resources to meet this demand. Money simply consists of intangible numbers and we can create as much as is necessary to put the production mechanism into action. There should be no artificial limit to the flow of production credit, as is the case in the current financial system.

Similarly, there should be no artificial limit to our consumption power in terms of unattached purchasing power or cost-liquidating income. In the current state of affairs, for $ 100 of cost/price that must be recovered from consumers, we only automatically provide, through the same production process, some of the purchasing power necessary in the form of incomes, say $ 50 (just to illustrate the point). The additional purchasing power of consumers required to clear the remaining production must come from additional production that is separate from the production currently on the market, or from consumers borrowing new money, or from favourable trade balances, and so on.

So Social Credit proposes that the National Credit Authority should also be responsible for determining the size of the recurring price-income gap for each economic period and compensating for it by creating and issuing without debt (or the need for repayment), additional consumer credits consumption in the form of a compensated price reduction and in the form of a National Dividend.

The compensated price would be a generalized reduction on all retail goods and services, reflecting actual production costs. Since the real costs of production are the consumption implied by this production (i.e., the costs of raw materials, labour, machinery, etc. used in production), nothing should cost more in financial terms than the costs associated with production, which is the corresponding consumption. Unfortunately, since companies often have to collect money to recover their capital expenditures, the prices of goods and services are artificially inflated above the money that consumers have received as incomes. The compensated price effectively removes these capex charges in prices, thus bringing them into closer reach of consumer incomes, while simultaneously reimbursing through the National Credit Authority the costs incurred by the retailers, so that their financial costs can be met in full.

The rest of the gap will be filled by the dividend. This money would constitute a direct disbursement of ‘debt-free’ credit to consumers in equal proportions as an income unrelated to employment status.

The compensated price and dividend will be issued in lieu of all conventional methods currently used to close the price-income gap. When these monies are received by retailers, they will be used to repay lines of credit (in this case, the money is destroyed) or to restore working capital (in this case, the money will not be re-injected except alongside a new set of costs).

In this way, the financial system will be restored to a state of perfect automatic equilibrium, where the flow of costs and, therefore, of price, is reflected by an equal flow of consumer purchasing power in the form of income offsetting the cost. It will no longer be necessary to try to cope with our costs by the futile exercise of attempting to borrow ourselves out of debt.