The modern, industrial system possesses an enormous productive capacity, both actual and potential, to meet our legitimate needs for goods and services. With every technological advancement we can produce more and/or better with less resource consumption and less human labour.

Now, if we had an honest financial system, i.e., one that accurately registered and reflected these physical economic realities, the cost of living would be much lower than it currently is and it would be falling steadily, while the decreased need for human input in the form of work would be represented by the continual expansion of paid leisure.

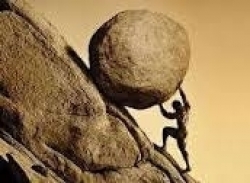

If, instead, we continue to operate under the existing dishonest and dysfunctional financial system, we condemn ourselves to Sisyphean exercises in futility, as we vainly struggle to make an insufficient flow of income cover an increasing flow of corresponding prices.

The choice between function and dysfunction is ours.